LIC New Jeevan Anand Plan:

Key Features of the policy – (Table 815)

- Life cover benefit continues to remain even after the maturity of the policy.

- Double Benefit of Financial protection against death of the policy holder and savings

- LIC’s Accidental Death and Disability Benefit Rider is available by making the payment of a nominal premium amount.

- Payment of regular premium is allowed to the policy holder.

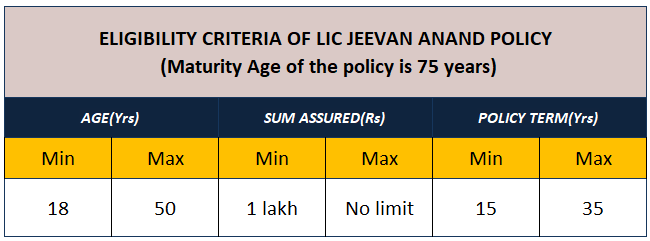

Eligibility criteria of this policy –

Documents required for purchasing the policy –

- Completely filled Application form with accurate information.

- Age Proof.

- Address Proof.

- Medical History.

- KYC documents such as Aadhaar Card, PAN Card, Tax Details, etc.

- Medical Diagnosis Reports as needed.

- Covid certificate mandatory.

A) Death Benefit – If the policy holder of LIC Jeevan Anand dies then the nominee of this policy will get sum assured along with the simple reversionary bonuses provided the policy holder has paid all due premiums.

B) Maturity Benefit – On maturity of the policy, the policy holder gets the following benefit –

- Basic sum assured

- Accrued bonuses or simple reversionary bonus

C) Reversionary Bonus – It is a bonus which a company pays to its policy holder at the time of maturity or as death benefit if the company is in profit.

D) Accidental and disability Benefit – This is an additional benefit which the policy holder or nominee gets on paying the extra premium on this policy. If there is a demise of the policy holder in an accident then the nominee gets extra sum assured on top of the basic sum assured.

Illustration of how this policy works?

Let us consider an example of Ram (IT professional,26 yrs old) who wants to buy the LIC’s New Jeevan Anand plan with a sum assured of Rs. 5,00,000 for a policy term of 21 years. If we assume that Ram will have to pay a yearly premium of Rs 27,454.

If ram survives till the maturity period, then he will receive a maturity benefit of the amount of Rs.11,02,000. But if Ram passes away before the maturity of the policy, then his nominee would receive 125% of the entire sum assured, as well as various other bonuses as applicable.

Does this policy comes with tax benefit?

This policy offers Tax benefit to the insured on the following –

- Premiums paid – The premiums paid for the plan are exempt from taxation under Section 80C of the Income Tax Act. The maximum exemption that can be availed is Rs. 1.5 lakhs.

- Claims Amount – Maturity or death claims received would be tax-free under Section 10(10D) of the Income Tax Act. There is no limit on the amount of claim received and the entire claim would be tax-free.

Does this policy provide a loan facility?

Yes, LIC Jeevan Anand Policy provides loan facility against the policy to the policy holder.

Conclusion –

As you all now know each and every details of the policy. if you feel that I have missed out on any important point, then please highlight in the comment section. Do Let me know If this Details has helped you to choose the best Life insurance policy and if you have any question the you can put it across in the comment section.

How To Purchase LIC’s New Jeevan Anand Plan (Table 815)

Since the

plan is not available for online purchase on the GIP website, you can buy it

via an offline method. You can visit to an office and the customer

representative present there will assist you in buying the plan. Make sure to

bring all your necessary documents to make your purchase seamless and

convenient. You can also make a call to the company’s customer care number to

ensure you bring the relevant documents to our office.

If you have any questions on this plan, please contact our team

and we would be happy to help.

Thank You,

Team

(Growmore

Insurance Point)